Here’s how we help you get it, quickly and easily

Thousands of Local Rated Professionals

We believe the best financial, legal and accounting advice is often found in highly rated, local firms. But how do you find the right one?

GENUINE REVIEWS

We go to extraordinary lengths to ensure client reviews on the site are genuine.

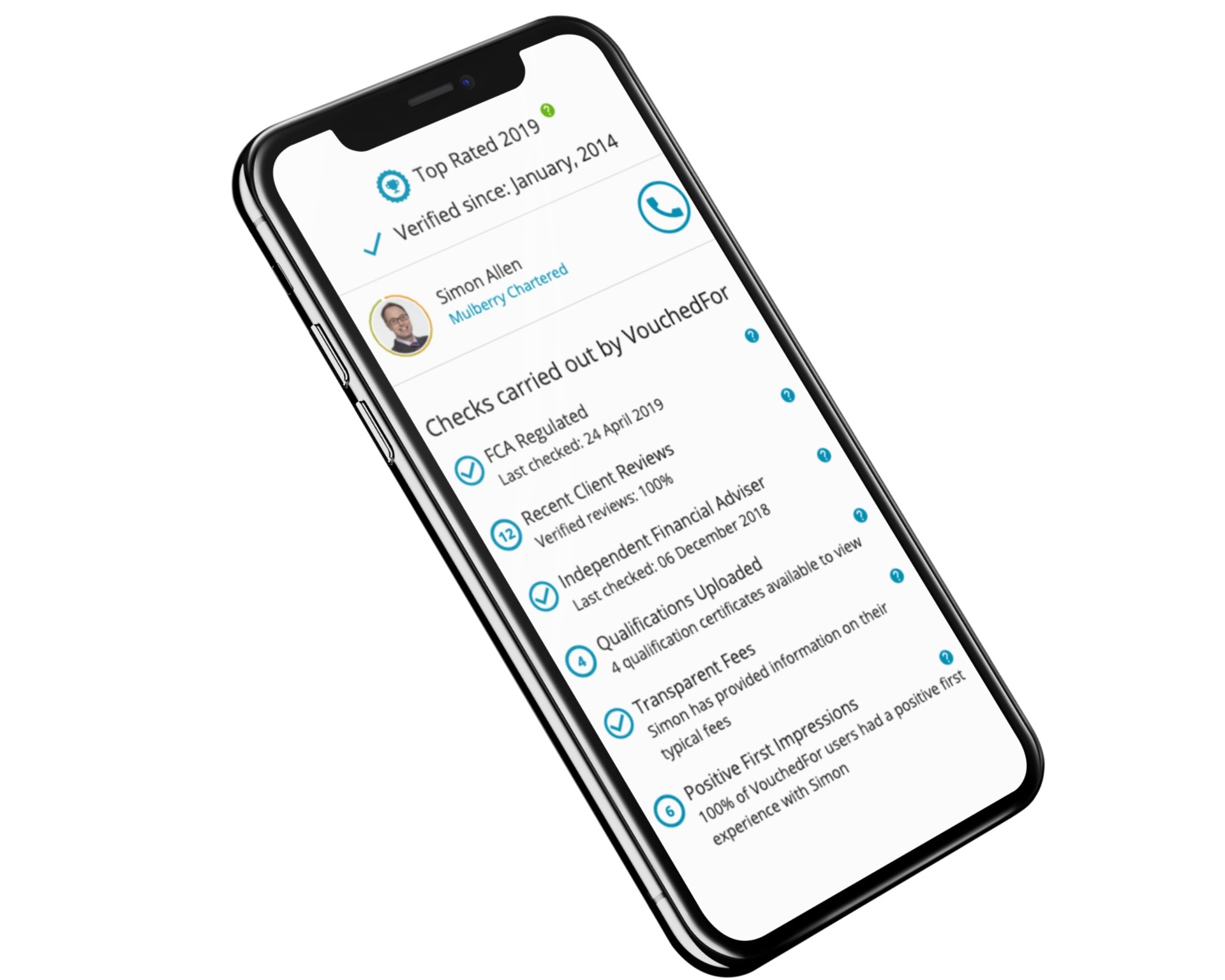

Extensive Vetting

We check all professionals against stringent criteria. We conduct more checks than any other UK site.

higher standards, lower costs

By shining a light on professionals' performance, we drive standards up. And if the best professionals are not having to spend lots of time and money drumming up business, or impressing clients with swanky offices, they can keep their charges down.

powerful stories

We let you quickly see which professionals have helped people like you, and how they did it… so you're left in little doubt who to contact.

The VouchedFor Standard

Financial Advisers are checked against the Financial Conduct Authority Register, their education is checked, their fees are checked and they must confirm their independent or restricted status. Please see the ‘Checks’ tab on their profiles for the full list

Mortgage Advisers are verified with their firms, which in turn are checked against the Financial Conduct Authority Register. Their education is checked and their fees are checked. Please see the 'checks' tab on their profiles for the full list.

Solicitors

Solicitors are checked against the Solicitors Regulation Authority, the Law Society of Scotland or the Law Society of Northern Ireland.

Accountants

Accountants on VouchedFor must be qualified member of one of the Chartered Accountancy bodies in the UK.

Genuine Reviews

We go to extraordinary lengths to ensure client reviews on the site are genuine. Here's how we do it:

Constant monitoring

We monitor numerous data to detect potentially fraudulent reviews, conducting investigations wherever required.

Fully verified reviews

We ask our professionals to verify each reviewer is a genuine client — which means unlike most review sites, we know exactly who's behind any fraud we spot (and hence we very rarely get any).

No cherry picking

Where a professional does not verify a reviewer, we contact the reviewer to verify their identity ourselves — so professionals can't just verify the clients they know like them!

No editing

We never edit reviews — whether good or bad — but we do provide advisers a public right of reply and will remove abusive ones where notified.

We also ask anyone who contacts a professional through VouchedFor to write a review after a couple of weeks. These are labelled as “First Impressions”.

How we make money

We want the website to be free for the public to use, so therefore we charge advisers a subscription fee to be a verified member of VouchedFor. We also charge advisers an enquiry fee for some enquiries submitted through the site.

These payments allow us to keep investing in the service we provide you. We always aim to provide better value-for-money than the other forms of marketing that professionals invest in — such that the end cost to you remains as low as possible.

In no way do payments influence reviews that are written — these come entirely from clients. Also, payments do not influence our search rankings, these are based on advisers' reviews and their distance from you.

Some advisers elect to join our free-of-charge membership plan, which still allows them to gather client reviews and show them to prospective new clients that they meet through other means. To see these advisers, you can un—tick a box in the “More search filters” area.

Find your professional adviser

Or, if you prefer, give us a call on 0203 111 0583 and we'll find the best adviser near you